History tends to repeat itself

History tends to repeat itself

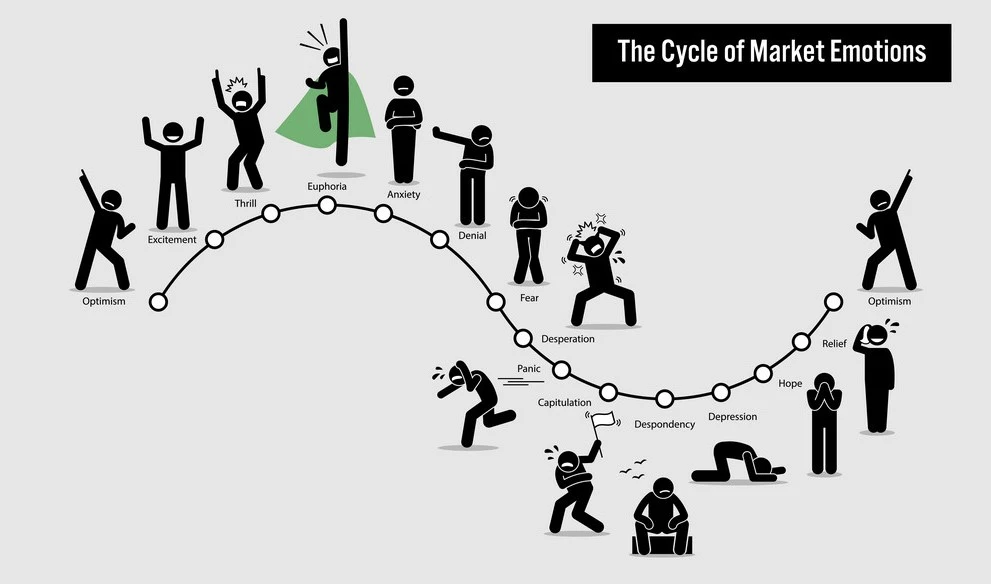

The phrase "history tends to repeat itself" suggests that events and patterns that have occurred in the past are likely to occur again in the future. This idea is often applied in various fields, including economics, politics, and investing.

In the context of investing, this phrase is often used to describe how certain market patterns and trends tend to repeat themselves over time. For example, some traders may look for specific chart patterns, such as the double bottom or head and shoulders, because they have historically been followed by certain price movements.

However, it`s important to note that history does not always repeat itself exactly. Market conditions can change, and unexpected events can impact the behavior of financial assets. Therefore, while past performance can be informative, it is not a guarantee of future results. Traders and investors should use historical data as one tool in their decision-making process, but they should also consider current market conditions and other factors that may impact the movement of financial assets. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.