What is Double Bottom Pattern?

Double Bottom Pattern

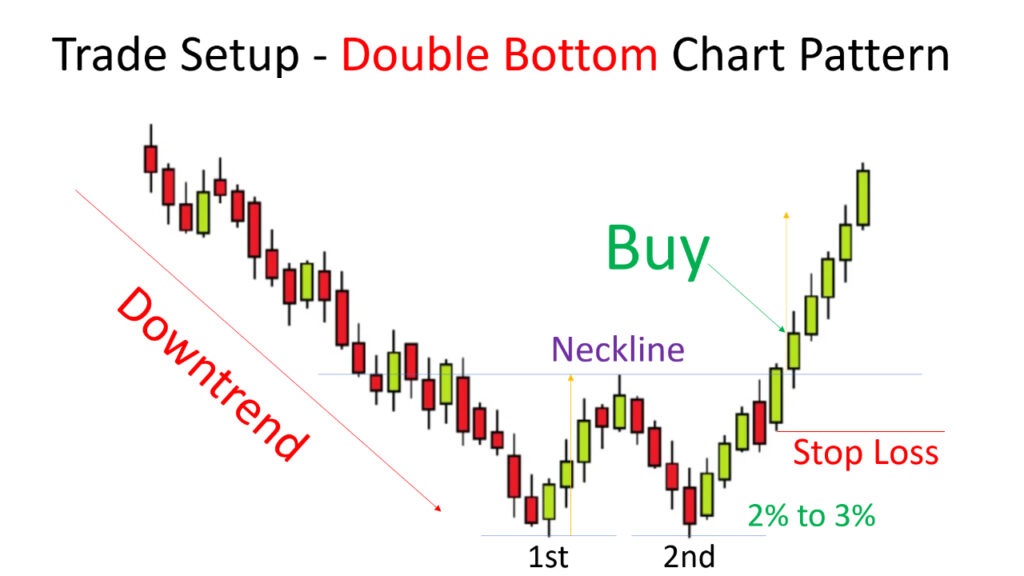

The Double Bottom Pattern is a bullish reversal pattern in technical analysis that signals a potential trend reversal from a downtrend to an uptrend. The pattern is identified by two consecutive bottoms at approximately the same level, separated by a peak in the middle. The pattern takes time to form and can take several weeks or months.

When a stock price falls to a certain level and bounces back up, it forms the first bottom. The price then declines again and reaches the same level as the first bottom, forming the second bottom. The middle peak is formed when the price attempts to recover but fails to break through the resistance level, creating a resistance area that forms the top of the pattern.

Traders typically look for a confirmation of the pattern when the price breaks through the resistance level on higher-than-average trading volume. This breakout is usually followed by an uptrend continuation, with traders setting a price target based on the height of the pattern.

It is important to note that not all double bottom patterns will result in a trend reversal, and traders should use caution and consider other technical indicators and market factors before making any trading decisions based solely on this pattern. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.