What is Engulfing Pattern?

Engulfing Pattern

An engulfing pattern is a candlestick chart pattern that is often used in technical analysis to signal a potential trend reversal. The pattern occurs when a small candlestick, referred to as the "engulfing" candlestick, is followed by a larger candlestick that completely "engulfs" the previous one.

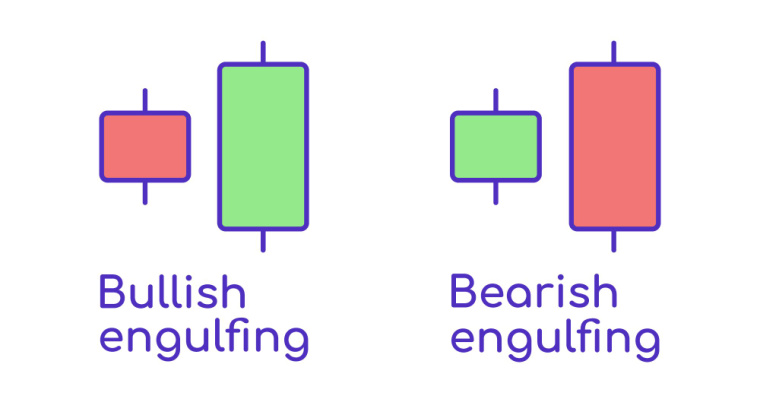

There are two types of engulfing patterns: bullish engulfing and bearish engulfing.

A bullish engulfing pattern occurs when a small red (bearish) candlestick is followed by a larger green (bullish) candlestick that completely engulfs the previous candlestick. This is interpreted as a bullish signal, suggesting that buying pressure has overcome selling pressure and that a potential trend reversal may be imminent.

On the other hand, a bearish engulfing pattern occurs when a small green (bullish) candlestick is followed by a larger red (bearish) candlestick that completely engulfs the previous candlestick. This is interpreted as a bearish signal, suggesting that selling pressure has overcome buying pressure and that a potential trend reversal may be imminent.

It`s important to note that an engulfing pattern should not be considered in isolation and should be analyzed in conjunction with other technical indicators and market factors before making any trading decisions. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.