What is Moving Average Crossover?

Moving Average Crossover

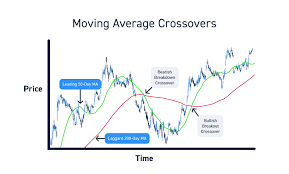

A Moving Average Crossover is a popular technical analysis trading strategy that involves using two or more moving averages to generate buy or sell signals. This strategy is based on the idea that when two different moving averages with different time periods intersect, it can signal a potential change in trend.

The most common type of Moving Average Crossover involves using two moving averages of different time periods. For example, a 50-day Simple Moving Average (SMA) and a 200-day SMA. When the shorter-term moving average (in this case, the 50-day SMA) crosses above the longer-term moving average (the 200-day SMA), it is considered a bullish signal and may indicate a potential upward trend. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it is considered a bearish signal and may indicate a potential downward trend.

Traders and investors may also use exponential moving averages (EMAs) instead of SMAs to generate Moving Average Crossover signals. EMAs give more weight to recent price data and may be more responsive to changes in trend than SMAs.

Moving Average Crossovers can also be used in combination with other technical indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to confirm signals and identify potential buy or sell opportunities. However, it`s important to note that no trading strategy is foolproof, and traders should always use appropriate risk management techniques to manage their positions. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.