What is The Morning Star pattern?

The Morning Star pattern

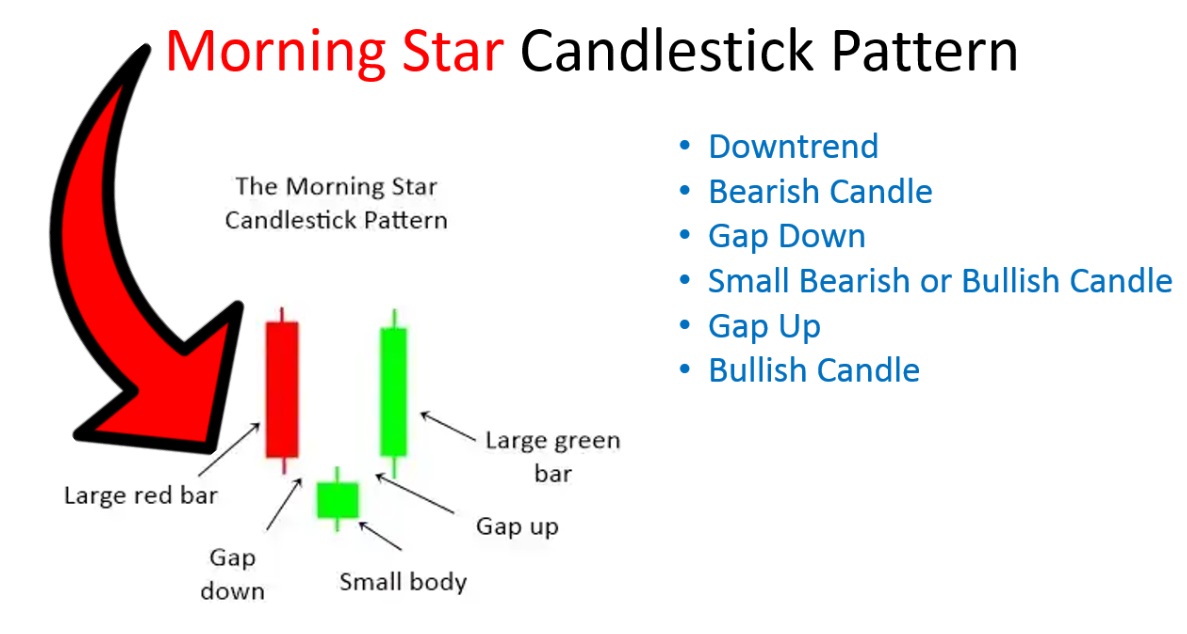

The Morning Star is a bullish candlestick pattern that forms at the bottom of a downtrend, signaling a potential reversal in price direction. The pattern consists of three candles:

The first candle is a long red or bearish candle, representing a continuation of the existing downtrend.

The second candle is a short candle, either red or green, that gaps down from the previous candle. This candle represents indecision in the market and a potential shift in sentiment.

The third candle is a long green or bullish candle that closes above the midpoint of the first candle, signaling a potential reversal in the trend and a shift in sentiment from bearish to bullish.

The Morning Star pattern is considered to be a strong bullish signal when it appears after a prolonged downtrend, indicating that the bears are losing control and the bulls are taking over. However, traders should be cautious and look for confirmation of the pattern through other technical indicators and market factors before making any trading decisions.

It`s also important to note that the Morning Star pattern can take different forms, such as the Bullish Abandoned Baby or Three Inside Up patterns, which are variations of the same concept. As with any trading strategy, traders should always use caution and consider other technical indicators and market factors before making any trading decisions based solely on a candlestick pattern.

|

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.