Which timeframe to choose?

Which timeframe to choose

Choosing the appropriate timeframe is an important aspect of trading and investing, as it can greatly affect the accuracy of your analysis and the success of your trades. The timeframe you choose depends on your trading style, goals, and strategy.

Here are some common timeframes used in trading and investing:

Long-term timeframe: Long-term traders typically hold positions for several months to years, and may use daily or weekly charts to analyze trends and make trading decisions.

Medium-term timeframe: Medium-term traders typically hold positions for several weeks to months, and may use daily or 4-hour charts to analyze trends and make trading decisions.

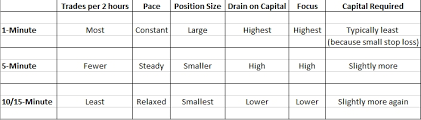

Short-term timeframe: Short-term traders typically hold positions for several minutes to hours, and may use 1-minute, 5-minute, or 15-minute charts to analyze trends and make trading decisions.

It is important to note that the shorter the timeframe, the more volatile and unpredictable the market can be. Short-term traders often use technical analysis to identify short-term trends and price movements, while long-term traders may focus more on fundamental analysis and the overall health and performance of the underlying asset.

Ultimately, the timeframe you choose should align with your trading goals, risk tolerance, and trading strategy. It is important to have a well-defined trading plan and to use proper risk management techniques when trading, regardless of the timeframe. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.