What is Average True Range Indicator?

Average True Range Indicator

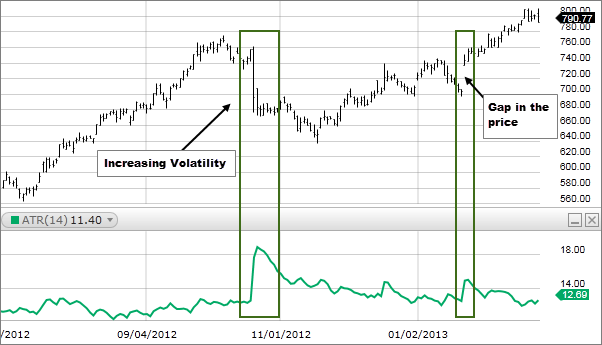

The Average True Range (ATR) indicator is a technical analysis tool that measures the volatility of an asset by calculating the average range of price movement over a certain period of time. Developed by J. Welles Wilder, the ATR indicator helps traders identify potential trend reversals, as well as levels of support and resistance.

The ATR indicator is calculated as the average of the true range over a certain number of periods. The true range is the greatest of the following:

The difference between the current period`s high and low. The absolute value of the difference between the current period`s high and the previous period`s close. The absolute value of the difference between the current period`s low and the previous period`s close. The ATR indicator is typically displayed as a line chart, with higher values indicating greater volatility and lower values indicating less volatility. Traders may use the ATR indicator to set stop-loss levels, as well as to determine the potential profit and loss of a trade based on the current volatility of the asset. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.