What is Bullish Flag Pattern?

Bullish Flag Pattern

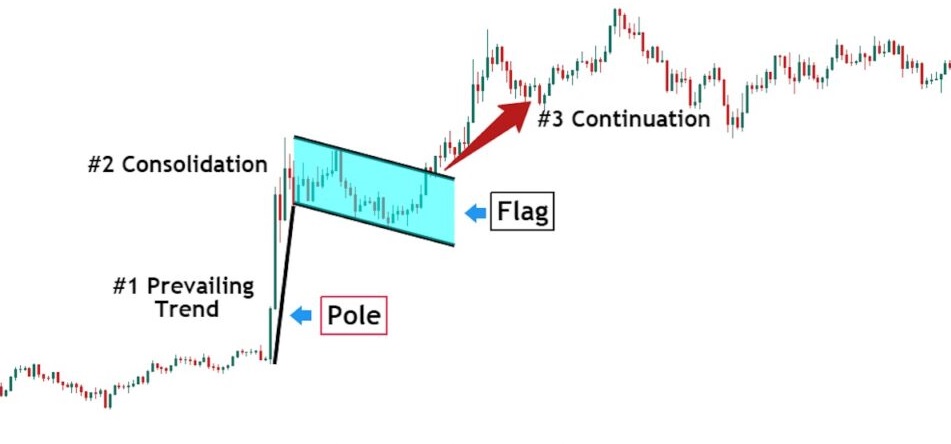

The Bullish Flag pattern is a continuation pattern in technical analysis that signals a potential trend continuation from an uptrend to an uptrend. It is identified by a short-term consolidation after a strong price move, forming a rectangular shape with two parallel trendlines. The pattern takes time to form and can take several days or weeks.

The Bullish Flag pattern is typically characterized by a sharp price move up (the flagpole) followed by a consolidation period (the flag), which forms a rectangle shape. The upper trendline of the rectangle acts as resistance, while the lower trendline acts as support. This consolidation period indicates that the buyers are taking a pause after the strong move up and may be preparing for another leg higher.

Traders typically look for a confirmation of the pattern when the price breaks through the upper trendline on higher-than-average trading volume. This breakout is usually followed by an uptrend continuation, with traders setting a price target based on the height of the flagpole.

It is important to note that not all Bullish Flag patterns will result in a trend continuation, and traders should use caution and consider other technical indicators and market factors before making any trading decisions based solely on this pattern. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.