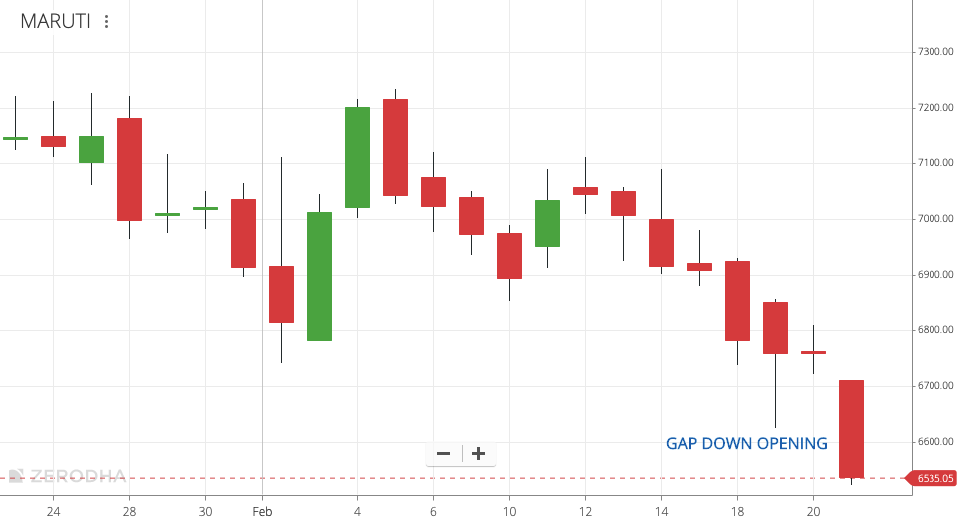

What is Gap down opening?

Gap down opening

A gap-down opening is a scenario in the stock market when the opening price of a stock or index is significantly lower than the previous day`s closing price, creating a downward gap on the price chart. This can happen due to a variety of reasons, such as negative news or announcements, unfavorable economic data, or a surge in supply for a particular stock.

For example, if a company announces worse-than-expected earnings after the market close, investors may become pessimistic about the stock`s future prospects and place sell orders, causing the price to gap down the following morning. Similarly, if there is a sudden increase in supply for a particular stock due to a negative news event, the price may gap down at the opening bell.

Gap-down openings can also provide trading opportunities for investors who are able to identify and take advantage of them. However, traders should be aware that gap-down openings can also be associated with increased volatility and risk, as the price may experience sharp movements in either direction as investors react to the news or announcement.

It`s important to note that gap-down openings are not always sustainable, and traders should always consider other technical indicators and market factors before making any trading decisions based solely on a gap. Additionally, it`s crucial to practice risk management and employ stop-loss orders to limit potential losses in case the trade doesn`t work out as expected. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.