What is Head and Shoulders Pattern?

Head and Shoulders Pattern

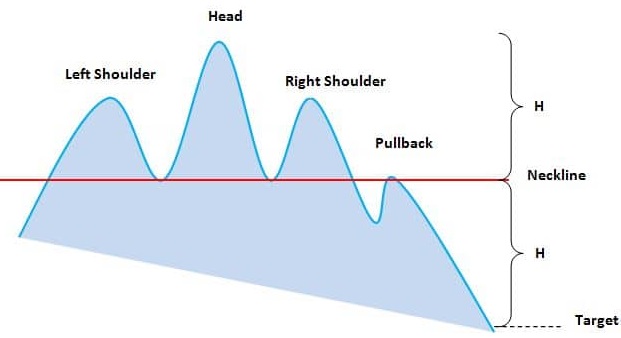

The Head and Shoulders pattern is a bearish reversal pattern in technical analysis that signals a potential trend reversal from an uptrend to a downtrend. The pattern is identified by three peaks, with the middle peak (the head) being the highest and the two outside peaks (the shoulders) being lower and approximately the same height. The pattern takes time to form and can take several weeks or months.

When a stock price rises to a certain level and bounces back down, it forms the first shoulder. The price then rises again to a higher level, forming the head. The price then falls again and bounces back up to approximately the same level as the first shoulder, forming the second shoulder. The pattern is completed when the price breaks through the neckline, which is a support level that connects the two bottoms formed by the shoulders.

Traders typically look for a confirmation of the pattern when the price breaks through the neckline on higher-than-average trading volume. This breakout is usually followed by a downtrend continuation, with traders setting a price target based on the height of the pattern.

It is important to note that not all Head and Shoulders patterns will result in a trend reversal, and traders should use caution and consider other technical indicators and market factors before making any trading decisions based solely on this pattern. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.