What is Spinning Top Candlestick?

Spinning Top Candlestick

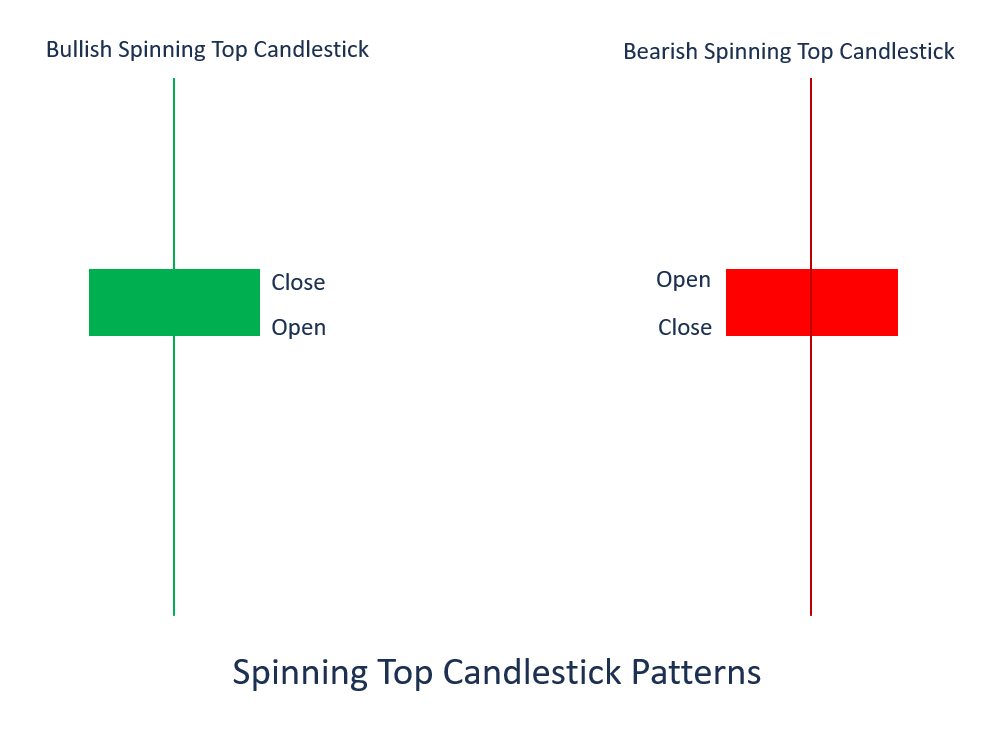

Spinning Top is a type of candlestick pattern used in technical analysis to represent indecision in the market. It is a single candlestick that has a small body and long upper and lower shadows or wicks. The body of the Spinning Top can be either bullish or bearish, but it is usually small compared to the size of the shadows.

The Spinning Top candlestick pattern indicates that the market is struggling to find direction and there is uncertainty among traders. The long shadows or wicks show that there was significant price movement during the trading session, but the small body shows that the opening and closing prices were close to each other. This suggests that neither the buyers nor the sellers were able to gain control during the session, and the market closed near the opening price.

Traders often interpret the Spinning Top pattern as a signal to be cautious, as it can signal a potential trend reversal or a consolidation phase. If the Spinning Top appears after a strong uptrend or downtrend, it can indicate a potential reversal in the trend. If it appears during a consolidation phase, it can signal that the market is likely to continue trading in a range.

It is important to confirm the signal with other technical indicators and analysis before making any trading decisions based on the Spinning Top pattern. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.