What is the Harami Pattern Pattern?

Harami Pattern Pattern

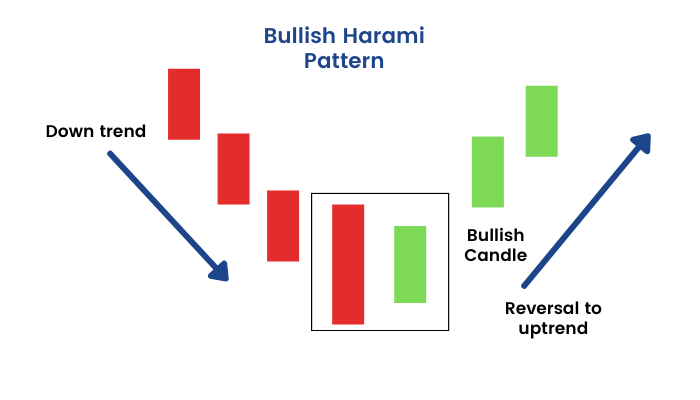

The harami pattern is a candlestick chart pattern that is used in technical analysis to signal a potential trend reversal. The pattern consists of two candlesticks, with the first candlestick being a long candlestick, and the second being a small candlestick that is completely engulfed by the first candlestick.

There are two types of harami patterns: bullish harami and bearish harami.

A bullish harami occurs when a long red (bearish) candlestick is followed by a small green (bullish) candlestick that is completely engulfed by the previous candlestick`s body. This is interpreted as a bullish signal, suggesting that the selling pressure has been overcome and that a potential trend reversal may be imminent.

On the other hand, a bearish harami occurs when a long green (bullish) candlestick is followed by a small red (bearish) candlestick that is completely engulfed by the previous candlestick`s body. This is interpreted as a bearish signal, suggesting that the buying pressure has been overcome and that a potential trend reversal may be imminent.

The strength of the harami pattern can be enhanced if the small candlestick is a doji, indicating indecision in the market. Additionally, traders may look for other technical indicators or market factors to confirm the potential trend reversal signaled by the harami pattern before making any trading decisions.

It`s important to note that the harami pattern is not a guarantee of a trend reversal and should be considered in the context of other technical indicators and market factors. Traders should always practice risk management and employ stop-loss orders to limit potential losses. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.