What is The evening Star pattern?

The evening Star pattern

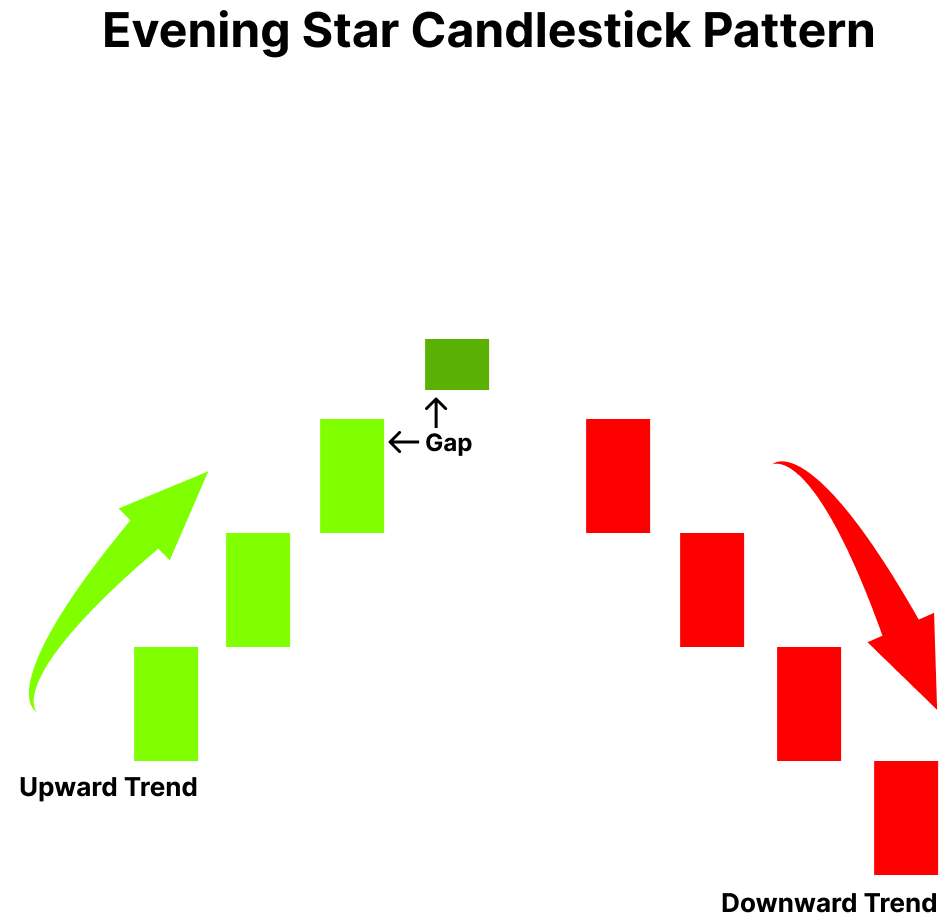

The Evening Star is a bearish candlestick pattern that forms at the top of an uptrend, signaling a potential reversal in price direction. The pattern consists of three candles:

The first candle is a long green or bullish candle, representing a continuation of the existing uptrend.

The second candle is a short candle, either red or green, that gaps up from the previous candle. This candle represents indecision in the market and a potential shift in sentiment.

The third candle is a long red or bearish candle that closes below the midpoint of the first candle, signaling a potential reversal in the trend and a shift in sentiment from bullish to bearish.

The Evening Star pattern is considered to be a strong bearish signal when it appears after a prolonged uptrend, indicating that the bulls are losing control and the bears are taking over. However, traders should be cautious and look for confirmation of the pattern through other technical indicators and market factors before making any trading decisions.

It`s also important to note that the Evening Star pattern can take different forms, such as the Bearish Abandoned Baby or Three Inside Down patterns, which are variations of the same concept. As with any trading strategy, traders should always use caution and consider other technical indicators and market factors before making any trading decisions based solely on a candlestick pattern. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.