What is The range breakout?

The range breakout

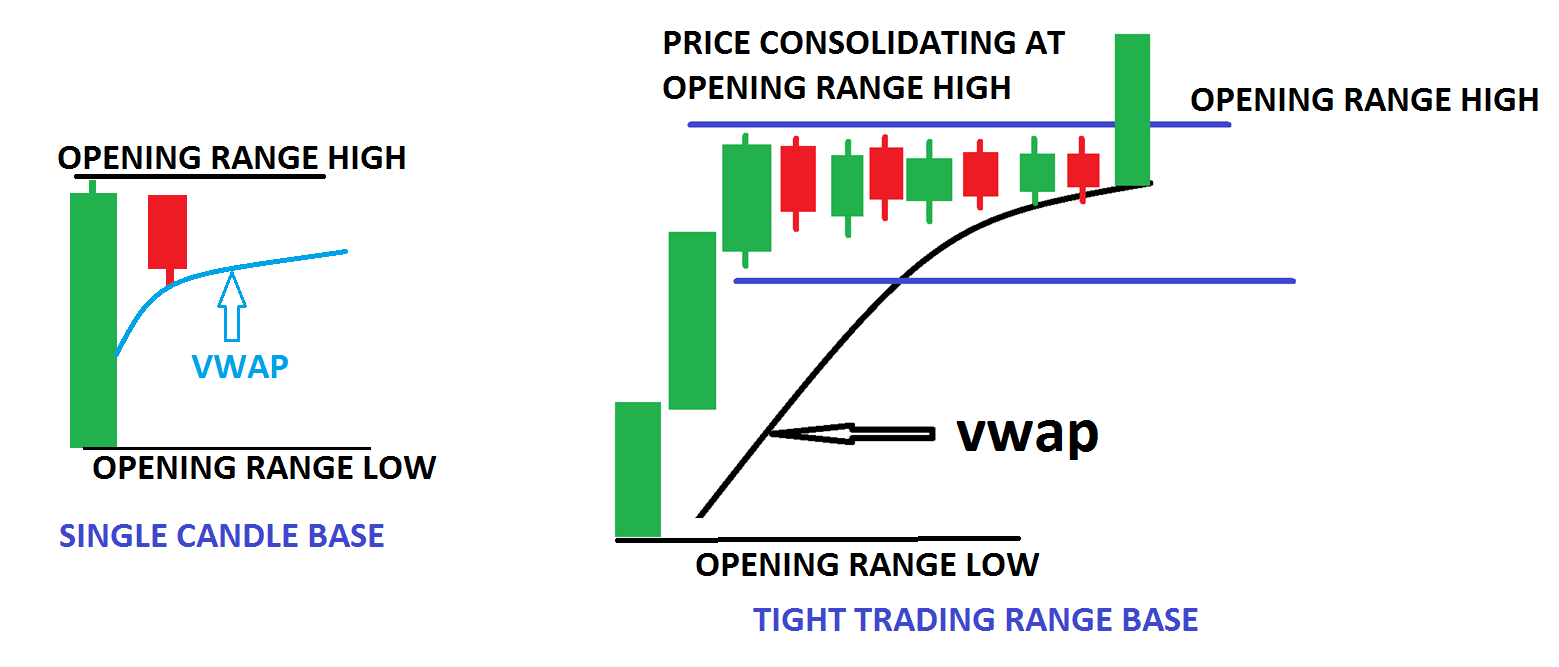

A range breakout occurs when the price of an asset breaks out of a trading range, or a period of time when the price has been moving within a relatively narrow range or a specific price range, without establishing a clear trend in either direction.

When the price breaks above the upper boundary of the trading range, it is considered a bullish breakout, indicating that buyers are taking control and the asset`s price may continue to rise. Conversely, when the price breaks below the lower boundary of the trading range, it is considered a bearish breakout, indicating that sellers are taking control and the asset`s price may continue to fall.

Traders often use technical analysis to identify trading ranges and potential breakout opportunities. They may use a variety of indicators and tools, such as trend lines, moving averages, and volume indicators, to identify support and resistance levels and to help determine when to enter or exit a trade.

Trading breakouts can be a popular strategy for traders seeking to capitalize on momentum and take advantage of potential price movements. However, breakouts can be unpredictable and false breakouts can occur, so traders should use proper risk management techniques and have a well-defined trading plan before entering a trade based on a range breakout. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.