What is the difference between Fundamental Analysis and Technical Analysis?

Difference between Fundamental Analysis and Technical Analysis

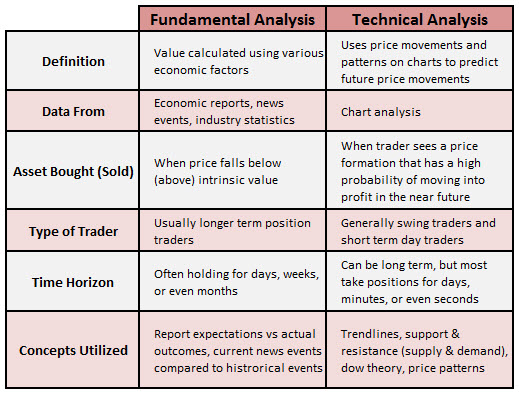

Fundamental analysis and technical analysis are two different approaches to analyzing securities such as stocks, currencies, or commodities.

Fundamental analysis involves examining a company`s financial and economic fundamentals, such as its earnings, revenue, assets, liabilities, and industry trends, in order to determine its intrinsic value. This analysis focuses on factors that affect a company`s long-term prospects and tries to assess the company`s overall health and future growth potential. Fundamental analysis is often used by long-term investors who are interested in the long-term prospects of a company.

On the other hand, technical analysis involves analyzing statistical data generated by market activity, such as past prices and volume, in order to identify patterns and trends that can be used to predict future price movements. This analysis focuses on market data rather than the underlying financial and economic fundamentals of a company. Technical analysis is often used by short-term traders who are interested in making quick profits based on market fluctuations.

In summary, the key difference between fundamental analysis and technical analysis is that fundamental analysis focuses on the underlying financial and economic fundamentals of a company, while technical analysis focuses on statistical data generated by market activity. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.