What is The Dow Theory?

The Dow Theory

The Dow Theory is a fundamental theory of technical analysis that was first introduced by Charles Dow in the late 1800s. The theory is based on the idea that the stock market moves in trends and that these trends can be analyzed to predict future market movements.

The Dow Theory is based on six main principles:

The market discounts everything: According to the Dow Theory, the market reflects all available information and events, including economic, political, and social factors.

The market moves in trends: The Dow Theory assumes that the market moves in trends, which can be classified as primary, secondary, and minor trends. The primary trend can last for several years and is the most important trend for investors to follow.

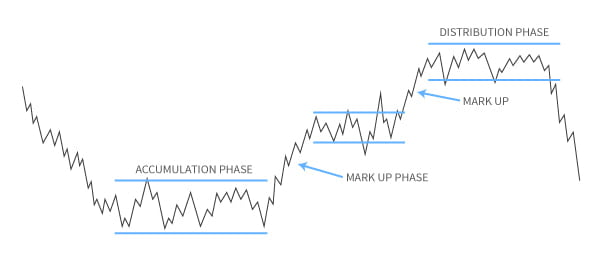

The primary trend has three phases: The primary trend has three phases: accumulation, public participation, and distribution. During the accumulation phase, smart money investors accumulate stocks while the general public is still skeptical. During the public participation phase, the general public starts buying stocks, and prices rise. During the distribution phase, smart money investors start selling stocks, and the market begins to decline.

Market averages must confirm each other: According to the Dow Theory, the industrial average and the transportation average must confirm each other to confirm the direction of the primary trend. If one average moves in one direction and the other average moves in the opposite direction, it may indicate a potential trend reversal.

Volume must confirm the trend: The Dow Theory assumes that volume should increase during the direction of the primary trend. If volume decreases during a rising trend or increases during a falling trend, it may indicate a potential trend reversal.

Trends persist until a clear reversal occurs: The Dow Theory assumes that trends persist until a clear reversal occurs. Therefore, investors should not try to predict short-term market movements but should focus on the primary trend and follow it until a clear reversal occurs.

The Dow Theory remains a popular tool among technical analysts today, and its principles are widely used to analyze and predict market movements. However, as with any trading strategy or theory, it`s important to thoroughly test and evaluate the effectiveness of the Dow Theory before using it in live trading. |

Latest Stock Market Tutorials

| 1. What is Descending Triangle Pattern? |

| 2. What is Bearish Pennant Pattern? |

| 3. What is Bearish Flag Pattern? |

| 4. What is Rising Wedge Pattern? |

| 5. What is Double Top Pattern? |

Free Stock Market Tutorials

| 1. Free Fundamental Analysis Course |

| 2. Free Technical Analysis Course |

| 3. Free Price Action Trading Course |

| 4. Free Futures & Options Course |

IMPORTANT ALERT! Information Posting in this website is only for educational purpose. We are not responsible for losses incurred in Trading based on this information.